Starting a small business is exciting because doing so points toward a sense of control and the opportunity to create personal wealth because of your own efforts. Unfortunately, this dream is only realized by a tiny percentage of small business owners. They struggle to have their businesses become money-generating machines for them and spend many of their days stressed out and overworked instead of basking in the joy of their success. Even if it goes pretty well, they still too often find themselves unsure of how to take advantage of their business success and build personal financial freedom.

In this Series, we’re reviewing the 6-Step Plan to run your business from Donald Miller’s latest book, How to Grow Your Small Business, and the online platform at businessmadesimple.com.

The analogy of an airplane helps describe the 6 Steps needed to run your business effectively and this week, we’re continuing with our final installment in Step 6, the Fuel, Your Cash Flow.

In this third and final part of Step 6, Don introduces the final checking account in the Playbook, the Investment Holding Account, as the place to collect the money that is the reason you started your business in the first place. This account grows the personal capital you can use to buy assets to make money without you even having to work.

After establishing your cash flow plans by the Playbook and adding this fifth and final account, your business will be set up to build wealth for you and your family.

Your Business Profit Account – Setting a High-Water Mark

When you set up your Profit Account, you establish a visible representation of the “extra” dollars produced by your business beyond one month of the operating expenses in your Operating Account. It’s motivating to see the Profit Account grow, as you know you’re building a buffer into your financial life.

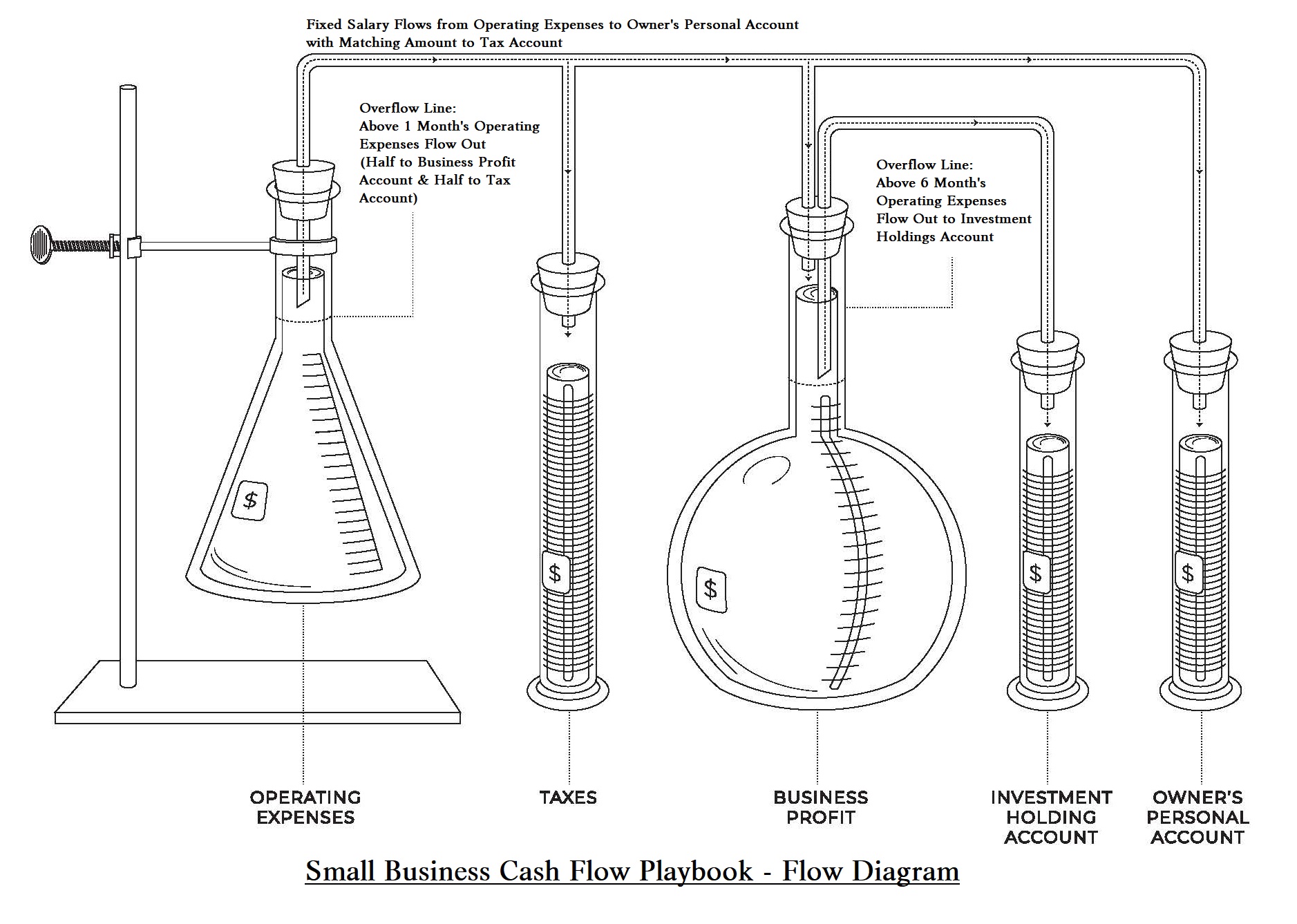

Once your Profit Account reaches the equivalent of six months of operating expenses, your safety net is well-positioned for unforeseen challenges. If necessary, you could operate your business without any sales for six months. That’s a huge accomplishment! Once you hit that threshold, the Playbook guides you to set up your final checking account, your Investment Holding Account. Any amount in your Profit Account above that six-month high-water mark should get swept into your Investment Holding Account. This time, you don’t have to split the amount you’re transferring with your Tax Account, as you’ve already got that covered when you first moved it out of your Operating Account. The following flow chart can help show the flow of money, now that we’ve described all the accounts of the Playbook.

The Investment Holding Account – A Big Goal of Your Business

The Investment Holding Account is the pinnacle of financial foresight in the Playbook. As funds exceeding the high water in your Profit Account “boil over” into your Investment Holding Account, you’ll start to see the realization of one of the ultimate goals of starting your business: building wealth toward financial freedom. The dollars growing in your Investment Holding Account, while maintaining a solid safety net in your Profit Account are a new opportunity for you. While it’s tempting to spend these extra “above and beyond” dollars on fun things like big toys, a new house, or an exciting vacation, the Playbook encourages you to invest them instead. Use these funds to invest in assets that make you money without you having to work for it. There are a variety of ways to invest that will provide a return, and the Playbook suggests that once the assets in the Investment Holding Account provide that return, you will have financial resources to spend on those fun things. That way, your investments will continue to regenerate for you month in and month out.

Your Investment Goals

As you install the Playbook into your business and your Profit Account begins to grow, it’s important to consider your Investment Goals and an Investment Plan, even before you reach the point of starting to put money into your Investment Holding Account. By having a vision of what you want to achieve with your accumulated wealth, you’ll be even more motivated to grow your business further.

Your goals can include a wide variety of items from fun items or experiences to charitable contributions or other ways to give back. Writing out your desired goals is important because doing so makes your vision more concrete. Ensure the list contains what you find most important or meaningful to you, as it will both motivate you and add a sense of accomplishment when you reach those goals.

Your Investment Plan

While your Investment Goals provide the target, your Investment Plan will keep you on track to achieve them. It’s easy to get distracted or jump the gun when dollars start showing up in the Investment Holding Account. That’s a big reason why the word “Holding” is in the title! Holding your investments allows them to grow. Instead of using the investments themselves, you can use the returns of those investments as the funds to spend on any of your Investment Goals that require dollars to achieve. That way, you’ll continue to have future opportunities while maintaining investments that continue to provide returns. Obviously, there are many kinds of investments you can make and we won’t make specific recommendations here.

Developing an Investment Plan typically involves investment professionals who can direct diversified investments to returns in both the short-term and long-term based on your specific Investment Goals. The more clearly you can define your goals, the better the planning can be to help you achieve them.

Adjusting Your Set Points as Your Business Grows

In the landscape of the Small Business Cash Flow Playbook, setpoints aren’t static; they evolve with your business. As your venture flourishes, it’s crucial to recalibrate these markers. As the operating expenses naturally rise with business expansion, the 1-month boil-over point in the Operating Expenses Account may need an upward nudge. This adjustment ensures that only surplus funds continue to flow into the Business Profit Account at the right pace. A sure sign that the set point is too low (or that spending is too high!) is that instead of having extra money that boils over, you’re dangerously close to running out of funds in your Operating Account.

Similarly, that monthly operating costs number factors into the 6-month boil-over benchmark for the Business Profit Account funds shifting into the Investment Holding Account. As your business grows, achieving your 6-month financial safety net will require more money before the excess is ready to be invested.

Elevating these setpoints is a celebratory nod to your business’s growth. However, a word of caution: delaying these adjustments can create unforeseen challenges. As the business scales, timely recalibration ensures smooth financial operations and continued prosperity.

Finally, reconsider your fixed salary amount that’s being withdrawn consistently. As your results and business conditions become more favorable, you might be able to give your paycheck a boost. Just make sure you factor the new amount into your set point calculations. Much better to have extra dollars flowing into the Profit and Investment Holding Accounts than to raise your salary too high, too quickly, requiring a return of dollars into the Operating Expenses Account to keep the business going.

Final Thoughts

Step 6 from Donald Miller’s book, How to Grow Your Small Business, is the Fuel – Your Cash Flow. We’ve discussed the Small Business Cash Flow Made Simple Playbook, a process to run your business that helps you stay in control of your business finances.

We’ve discussed the following big objectives of the Playbook:

- You can view the overall health of your business in an instant.

- You have a clear delineation between your business and your personal finances, separated so that your business is standing on its own.

- You won’t ever be short of cash when Uncle Sam shows up looking for his tax money.

- You know your business can suffer a loss and/or survive a crisis, and you can keep operating because you’ve put plenty of money away for a rainy day.

- You can see how much money you’re putting away to create personal wealth for yourself and your family.

Building your business so that it becomes a money-making machine providing those benefits to you can also bring peace of mind as you deal with the myriad of challenges in running a small business. Clear visibility of your cash position is critical, as running out of cash is the number one cause of small business failures. Cash flow is the fuel that will keep your small business airplane in the sky.

Next week, we’ll wrap up our entire series reviewing Donald Miller’s book, How to Grow Your Small Business, providing the key points for each part of your small business airplane so you can fly far and fast into your successful future.

Need CNC Machined Parts from a Shop You Can Trust? We’re Happy to Help!